Struggling with credit card debt? You’re not alone – U.S. consumer credit card debt reached $1.21 trillion in late 2024. Tackling this starts with one simple step: tracking your expenses. Why? Because it helps you see exactly where your money is going, identify overspending, and redirect funds toward paying off debt faster.

Here’s what you need to know:

- Expense tracking highlights spending habits and reveals areas to cut back.

- It helps you spot unnecessary costs like unused subscriptions or impulse purchases.

- Tools like apps or manual tracking can simplify the process.

- By reallocating small savings (like $150/month from takeout), you can make extra debt payments.

- Two repayment strategies – debt avalanche (focus on high-interest debt) and debt snowball (start with small balances) – can speed up your progress.

Tracking expenses isn’t just about numbers; it’s about taking control and creating a practical plan to pay off debt. Start today by reviewing your spending, setting clear goals, and sticking to a repayment strategy that works for you.

How I Paid Off $40K of Debt in 1 Year | My 4-Step Strategy

The Problem: Why Credit Card Debt Continues to Grow

Credit card debt often snowballs due to habitual overspending, unexpected financial obligations, and the relentless impact of high interest rates. With average credit card interest hovering around 22% – and some cards charging even more – a large chunk of your payment often goes straight to interest, leaving little to chip away at the principal balance. This makes getting out of debt feel like an uphill battle.

Take a big purchase, for example. You might plan to pay it off quickly, but life happens – unexpected expenses or a sudden drop in income might leave you making only the minimum payments. Over time, compounding interest takes over, causing your balance to grow month after month. It’s a cycle that many Americans find themselves trapped in, with nearly 10% of credit card accounts currently delinquent. This isn’t just about individual habits; it reflects broader trends in spending and gaps in financial knowledge.

Common Spending Triggers in the U.S.

Spending habits in the U.S. have shifted significantly over the past decade. Credit cards now account for 34.5% of consumer payments, a sharp increase from 18.3% in 2015. But what’s driving this reliance on credit? Several behaviors stand out.

Using credit cards for everyday essentials – like gas, groceries, and utilities – without a solid repayment plan is a red flag. When your card becomes a crutch for covering basic needs, it’s a sign that your expenses may be outpacing your income.

Online shopping has also made spending dangerously easy. The convenience of a few clicks today turns into a bill tomorrow, often catching people off guard. Dining out is another culprit. Whether it’s takeout or a quick lunch, these seemingly small expenses can pile up, especially when paired with high interest rates.

Then there’s the temptation to open multiple credit card accounts. While it might seem like a good idea to take advantage of rewards or promotional offers, it can backfire. Opening several accounts in a short period can hurt your credit score and encourage overspending. As the Consumer Financial Protection Bureau puts it:

"If you apply for a lot of credit over a short period of time, it may appear to lenders that your economic circumstances have changed negatively."

How Debt Stress Affects Your Decisions

These spending habits, combined with the stress of mounting debt, can cloud judgment. Financial worries often lead to impulsive purchases or even avoidance of financial responsibilities altogether. A Forbes Advisor survey from February 2023 revealed that 47% of U.S. cardholders either don’t know or aren’t sure about the interest rate on their credit card. This lack of awareness isn’t just about poor financial education – it’s also a coping mechanism for dealing with overwhelming debt.

Relying on minimum payments only prolongs the debt cycle. Ignoring early warning signs, like consistently high balances or difficulty making payments, can make the situation worse.

Financial literacy plays a critical role here. Globally, only one in three adults understands basic financial concepts. Without a solid grasp of how interest compounds or how minimum payments work, it’s easy to underestimate your debt and continue overspending.

Ted Rossman, Senior Industry Analyst at Bankrate, notes how economic uncertainty shapes consumer behavior:

"Consumers have been in a pretty frugal mood lately."

Unfortunately, this frugality often comes too late – after debt has already piled up. Recognizing spending patterns early is key, and tracking your expenses is a powerful way to identify and correct overspending before it spirals out of control.

How Expense Tracking Reveals Where Your Money Goes

If you’re serious about paying off credit card debt, the first step is understanding exactly where your money is going. Tracking your expenses sheds light on your spending habits, often uncovering costs you didn’t even realize were adding up. This clarity is essential – after all, you can’t fix what you don’t see.

As NerdWallet puts it:

"Tracking your expenses on a regular basis can give you an accurate picture of where your money is going – and where you’d like it to go instead."

Take small recurring expenses as an example: a $5.99 streaming subscription, $15 lunches, or $200 in takeout. These seemingly minor costs can snowball quickly. In fact, new budgeters often save $600 within their first two months and over $6,000 in their first year just by tracking their spending. Once you see where your money is going, you can take the next step – choosing a tracking method that works for you.

Ways to Track Your Expenses

You don’t need high-tech tools or complicated systems to start tracking. The key is to pick a method that fits your lifestyle and stick with it. Whether you prefer a hands-on approach or automated help, there are two main options: manual tracking and digital tools.

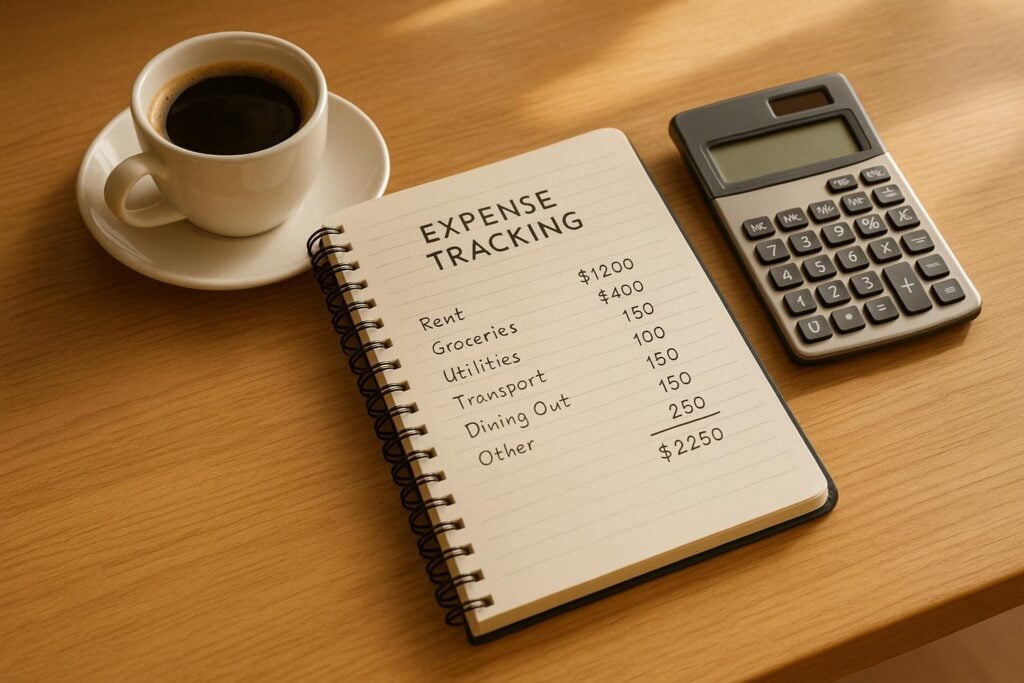

Manual tracking is as simple as jotting down every expense in a notebook, on a spreadsheet, or even on a piece of paper. This approach gives you total control, and the act of writing down each purchase can make you more mindful of your spending.

Digital tools and apps simplify the process by automating much of the work. They can categorize expenses, analyze spending patterns, and provide real-time updates. Some popular options include:

- YNAB (You Need A Budget): $109 per year, rated 4.8 stars by over 50,000 Apple App Store users.

- Goodbudget: A free app with 4.6 stars from more than 12,000 Apple users.

- PocketGuard: $74.99 annually, designed to help prevent overspending.

- Monarch Money: $69.99 annually, offering advanced features and boasting a 4.9-star rating from over 28,000 Apple users.

The best tool is the one you’ll use consistently. Whether you prefer writing things down or letting an app do the heavy lifting, consistency is what will make the difference.

What Your Spending Data Tells You

Tracking your expenses for even a single month can reveal patterns that reshape how you think about money. Old National Bank explains:

"When you keep track of every penny that you spend, you start to see patterns in your spending habits, and these patterns will help you to identify areas where you could be saving money."

Start by categorizing your expenses into two groups: essential costs (like housing, utilities, groceries, and transportation) and discretionary spending (such as dining out, entertainment, and hobbies). Look for spikes in spending during certain times – holidays, birthdays, or even specific days of the week. These insights can highlight areas where you can cut back and redirect funds toward debt repayment.

Subscriptions are another common culprit. Many people forget about recurring charges for services they no longer use. Reviewing your credit card statements can help you spot these hidden costs. According to Rocket Money, 80% of its users save money by canceling unwanted subscriptions.

Daily conveniences can also add up in surprising ways. For instance, that $4 coffee you grab every morning might seem harmless, but it adds up to $120 a month – or $1,440 a year. Similarly, frequent takeout, ride-sharing, and impulse online purchases can drain your budget without you realizing it. Knowing the actual cost of these habits helps you make smarter choices.

Comparing your spending to your income and debt payments can also provide valuable perspective. For example, if you’re spending $300 a month dining out while only making minimum payments on $5,000 of credit card debt, it’s clear how redirecting that money could help you pay down your balance faster.

Tracking expenses can also reveal emotional or situational triggers that lead to overspending. Maybe you shop online when you’re stressed, splurge on weekends, or choose expensive lunches when you’re short on time. Recognizing these triggers is the first step toward breaking the cycle.

As Firstcomcu.org puts it:

"By actively identifying and eliminating expenses, you’re taking charge of your financial well-being. Instilling these disciplined spending habits today, will set you on a path toward a more secure and profitable future."

When you understand how much you’re spending – and where – you can make deliberate choices. For example, cutting back on takeout by $150 a month could allow you to make an extra payment toward your credit card debt. This kind of visibility turns vague financial goals into actionable steps, helping you take control of your money and work toward a debt-free future.

From Tracking to Budgeting: Creating Your Debt Payoff Plan

Once you’ve got a clear picture of your spending habits, it’s time to turn that information into a practical budget that supports your debt repayment goals. By analyzing where your money goes, you can create a plan that prioritizes essentials while freeing up funds to tackle your credit card balances.

As Brynne Conroy from LendingTree puts it:

"Even if you’re deep in debt, escape is possible with the help of a solid budget and repayment plan."

Start by taking a full inventory of your financial situation. This includes listing your savings, assets, debts, income, and monthly expenses. Then, organize your spending into categories like housing, transportation, food, and entertainment. This breakdown helps you identify patterns and pinpoint areas where adjustments can have the biggest impact on your debt repayment journey.

One tool to guide your budgeting is the 50/30/20 rule. This method divides your after-tax income into three parts: 50% for necessities, 30% for discretionary spending, and 20% for financial goals, such as paying down debt. Using this framework alongside your tracked expenses can help you prioritize effectively.

Setting Priorities: Needs vs. Wants

Tracking your expenses makes it easier to separate essential costs from non-essential ones. Essentials typically include housing, utilities, groceries, transportation, insurance, and minimum debt payments. On the other hand, wants cover things like dining out, entertainment, and subscriptions – expenses that can often be reduced or paused.

Take a close look at your spending and identify areas to cut back. For instance, review recurring subscriptions and eliminate the ones you don’t use. Even small changes can add up. If you’re spending $150 each month on streaming services and subscriptions, canceling the unused ones could free up extra cash for debt payments.

Small daily expenses are another area to watch. That $2 coffee you buy every workday? It adds up to about $500 a year. When the average American carries $90,460 in debt, every dollar saved can make a difference. By spotting these spending habits, you can make focused changes instead of randomly slashing your budget.

Making Debt Payments a Budget Priority

Once you’ve trimmed non-essential spending, redirect those savings toward paying down your debt. After covering your essential expenses, debt repayment should be your next priority. Many financial experts recommend treating credit card payments as part of your “needs” category, ensuring they’re paid consistently – even during tight months.

To figure out how much you can allocate toward debt, subtract your essential expenses from your after-tax income. Bruce McClary, spokesman for the National Foundation for Credit Counseling (NFCC), advises:

"Assuming that your mortgage or rent are going to consume the lion’s share of that [‘needs’] category, I recommend keeping credit card payments below 10% of your monthly take-home pay if you aren’t in a position to affordably pay off your entire balance each month."

Consider adding extra payments to your budget as well. Even an additional 5-10% of your remaining income directed toward the principal can speed up your progress. For example, if you have $500 left after covering essentials, putting an extra $25–$50 toward your debt can make a noticeable difference over time.

As Brynne Conroy emphasizes:

"The more specific you are with your debt repayment goals, the more likely you are to hit them."

Set clear and measurable goals with defined timelines. Instead of saying, “I want to pay off my credit cards,” aim for something like, “I will pay off my $3,000 Visa card in 18 months by making $200 monthly payments.” This level of detail, combined with insights from your expense tracking, gives you a solid roadmap.

Finally, keep an eye on your progress by reviewing your budget and spending each month. As your financial situation changes, adjust your plan to stay on track. The habits you’ve built through expense tracking will help you avoid falling back into old patterns that could derail your efforts.

For more guidance on structuring your debt repayment plan, check out Steps To Be Debt Free (https://debtloansrelief.com).

sbb-itb-2a9374f

Choosing a Debt Repayment Strategy: Avalanche vs. Snowball

Once you’ve established a solid budget and identified extra funds, the next step is deciding which debts to prioritize. By analyzing your expense tracking data, you can determine how much extra cash you can put toward debt each month. This sets the stage for choosing between two popular repayment strategies: the debt avalanche and debt snowball methods.

As Navy Federal Credit Union wisely states:

"The best debt repayment plan is the one you can stick with until you’re debt-free."

Debt Avalanche Method

The debt avalanche method is all about efficiency and saving money in the long run. Here’s how it works: you list your debts from the highest to the lowest interest rate. Then, you apply any extra funds to the debt with the highest interest while continuing to make minimum payments on all others.

For example, if you have an extra $3,000 each month, you could tackle a $10,000 credit card balance with an 18.99% APR first. Using this method, you’d be debt-free in 11 months and pay $1,011.60 in total interest. This approach is ideal for those who are motivated by reducing overall costs and maximizing long-term savings.

Debt Snowball Method

The debt snowball method takes a different approach, focusing on building momentum through small victories. With this strategy, you pay off your smallest debt first, regardless of the interest rate, while making minimum payments on the rest.

If you follow this method, you’d still be debt-free in 11 months, but you’d pay $1,514.97 in total interest – roughly $503 more than the avalanche method. However, the psychological boost of quickly eliminating smaller debts can help keep you motivated and on track.

Avalanche vs. Snowball Comparison

| Factor | Debt Avalanche Method | Debt Snowball Method |

|---|---|---|

| Repayment approach | Highest interest rate to lowest | Smallest balance to largest |

| Total interest paid | Generally lower | Generally higher |

| Main advantage | Saves money on interest over time | Builds motivation with quick wins |

| Flexibility | Focuses on high-interest debts | Easily shifts focus after payoffs |

| Best for | Those minimizing interest costs | Those who need fast progress |

Each method has its strengths, catering to different priorities. The avalanche method is perfect for minimizing costs, while the snowball method provides emotional wins that can help you stay committed. Your spending data not only reveals how much you can allocate but also helps you choose the strategy that best fits your financial goals.

As Navy Federal Credit Union reminds us:

"It’s OK to start with one method and switch to another if you find it’s not working."

Staying on Track: Maintaining Your Progress Long-Term

Paying off credit card debt isn’t a sprint – it’s more like a marathon that requires steady effort and determination. Once you’ve started making progress, the real challenge lies in staying committed to your plan. Consistently tracking your expenses plays a crucial role in making adjustments and ensuring you stick to your repayment goals.

Regular Check-ins and Budget Updates

Make it a habit to review your budget every month. Compare what you actually spent to what you had planned, and address any differences right away. These regular check-ins help keep your budget on point and give you a chance to celebrate the progress you’ve made.

Celebrating Your Wins

Paying off debt is no small feat, and celebrating milestones along the way can keep you motivated. As Melissa Cox, a CERTIFIED FINANCIAL PLANNER™, puts it:

"Celebrating financial milestones keeps you motivated, reinforces positive financial behaviors, and helps you enjoy the journey toward financial freedom."

Celebrations don’t need to be extravagant. When you hit a major milestone, like paying off your first credit card or clearing a big chunk of debt, think about low-cost ways to mark the occasion. This could be a simple outing, like a hike or a trip to a free museum, or even treating yourself to an affordable meal. Some people create lasting memories by documenting these milestones in a journal or photo album.

These small celebrations not only mark your progress but also encourage you to stick to your disciplined spending habits. They’re a great way to reward yourself without falling back into old patterns.

Avoiding Old Spending Habits

Your expense tracking system is more than just a tool – it’s a safeguard that helps you recognize and avoid the spending habits that may have led to debt in the first place. Maintaining financial discipline often requires a shift in mindset, as financial expert Anna Barker from LogicalDollar explains:

"Carrying debt is seen as completely normal – which it absolutely shouldn’t be. This is why any effort to cut expenses will also have to be accompanied by a shift in mindset."

To avoid slipping back into bad habits, set clear boundaries for how and when you’ll use credit cards. If you decide to use them again, assign each card a specific purpose and consider removing your credit card details from online accounts to make spending more intentional.

Practical strategies, like using the envelope system or sticking to a shopping list, can also help you stay on track. You might even find it helpful to team up with an accountability buddy or revisit your financial goals periodically to stay motivated.

Sometimes, breaking free from old habits requires deeper self-reflection. If you notice yourself falling back into familiar patterns, it might be worth consulting a financial counselor for guidance. Your expense tracking data can serve as an early warning system, helping you catch small mistakes before they snowball into bigger issues.

For more detailed advice on managing and reducing credit card debt, check out the step-by-step guide at Steps To Be Debt Free.

Conclusion: Taking Control of Your Finances

Expense tracking is more than just jotting down numbers – it’s a way to regain control over your financial life. As Garrett Zimmermann, Author at Munn Wealth Management, explains:

"Mastering your finances isn’t about restriction – it’s about empowerment, giving you the freedom to spend intentionally and build a secure financial future."

By understanding your spending habits, you can create a clear path toward financial stability. Expense tracking lays the groundwork for smarter budgeting and tackling debt. It starts with identifying where your money goes – spotting both the areas you manage well and those that could use improvement.

With this knowledge, you can craft a budget that prioritizes paying off debt while covering your essential needs. Whether you opt for the debt avalanche or snowball method, the insights from your tracked expenses will guide your decisions every step of the way.

Begin by reviewing your accounts and categorizing your expenses into needs, wants, and debt payments. You don’t need any fancy tools – a simple spreadsheet or even a notebook works just fine. The key is staying consistent and being honest about where your money is going.

This approach turns vague financial goals into actionable steps. Many people are surprised to discover how much they spend on non-essentials, but tracking expenses makes these hidden costs impossible to ignore.

Beyond paying off debt, tracking your spending can help you improve your credit, grow your savings, and reduce financial stress. It shifts you from reacting to money problems to actively preventing them.

If you’re looking for a step-by-step guide on reducing credit card debt, check out Steps To Be Debt Free. This resource can help you take charge of your finances right away.

Start today – review your account statements, try a budgeting app, or simply write down your purchases. Taking this first step puts you on the path to financial stability and peace of mind.

FAQs

What are some simple ways to track my expenses without using apps or digital tools?

If you’re not into digital tools, you can always go back to basics with pen and paper. Grab a notebook or a sheet of paper and jot down every purchase you make. Make sure to note the date, amount spent, and a short category (like groceries, utilities, or entertainment) for each entry.

To keep up with it, dedicate a few minutes daily to update your records. You could also take some time each week or month to review your notes, look for spending patterns, and figure out where you might cut back. The trick is to keep it simple and stick with it!

How does the debt snowball method keep me motivated to pay off credit card debt?

The debt snowball method is a popular strategy for tackling debt because it emphasizes paying off your smallest balances first. This approach lets you see quick wins early on, giving you a sense of accomplishment that can be incredibly motivating. Clearing smaller debts feels like progress, and that boost in confidence can make it easier to stay on track.

As you check off each paid-off debt, the momentum builds. This growing sense of progress fuels your determination to keep going, helping you stay focused on the ultimate goal: becoming debt-free.

Should I focus on paying off high-interest credit card debt or smaller balances first?

If you’re aiming to save the most money in the long run, focusing on paying off high-interest credit card debt first is usually the smartest move. By cutting down on the hefty interest charges, you’ll be able to chip away at your debt more efficiently and reduce the total amount you owe.

On the other hand, if you’re feeling overwhelmed or struggling to stay motivated, tackling smaller balances first might be a better approach. Clearing those smaller debts quickly can give you a sense of accomplishment and free up extra cash for other payments, helping you stay on track.

The best method really depends on your financial circumstances and what helps you stay motivated to manage your debt effectively.