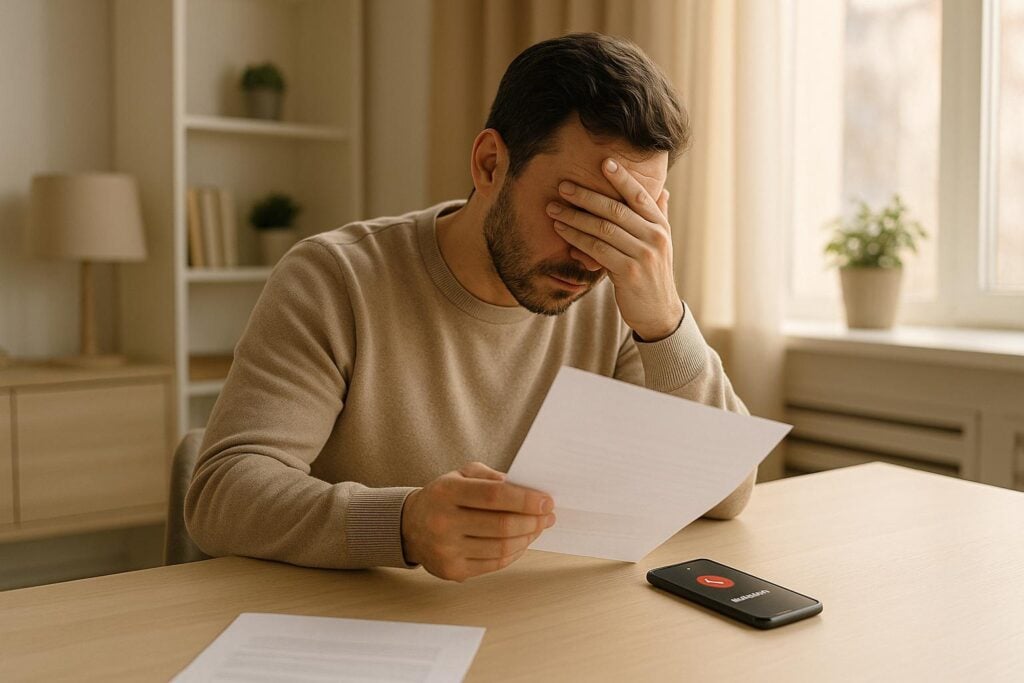

Feeling overwhelmed by creditor harassment? You’re not alone, and the law is on your side. Debt collectors cannot legally use abusive tactics, excessive calls, or threats to pressure you into paying. The Fair Debt Collection Practices Act (FDCPA) protects you from such behavior, and state laws often provide additional safeguards.

Here’s what you can do to stop harassment:

- Know Your Rights: Collectors can’t call before 8 AM or after 9 PM, use abusive language, or contact third parties about your debt.

- Document Everything: Keep records of all calls, letters, and interactions.

- Request Debt Validation: Ask for written proof of the debt’s legitimacy within 30 days of their first contact.

- Send a Cease-and-Desist Letter: Legally demand they stop contacting you.

- Report Violations: File complaints with the Consumer Financial Protection Bureau (CFPB), Federal Trade Commission (FTC), or your state attorney general.

- Seek Legal Help: If harassment persists, consult an attorney to protect your rights and explore options like suing the creditor or filing for bankruptcy.

Whether you choose to handle it yourself or hire a lawyer, taking action can stop the harassment and help you regain control of your finances.

Legal Steps to Stop Debt Collectors from Harassing You

How U.S. Laws Protect You From Creditor Harassment

Both federal and state laws work together to shield you from abusive tactics by debt collectors. These legal protections ensure you have recourse if creditors cross the line, empowering you to take action when harassment occurs.

Your Rights Under the Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is the cornerstone of federal protections against abusive debt collection practices. It specifically governs debts related to personal, family, or household purposes – like credit cards, medical bills, car loans, and mortgages.

Under the FDCPA, debt collectors are strictly prohibited from engaging in certain behaviors, such as:

- Repeatedly calling with the intent to harass.

- Using obscene or abusive language.

- Threatening violence or making false claims about the debt.

- Contacting you outside the hours of 8:00 AM to 9:00 PM in your local time zone.

- Discussing your debt with third parties, such as family members or coworkers.

- Ignoring your attorney if you’re represented by one – they must communicate through your lawyer.

If a debt collector violates these rules, you have the right to sue them. Successful lawsuits can result in compensation, including up to $1,000 for statutory damages, reimbursement for actual harm, and coverage of attorney’s fees and court costs.

State Laws That Protect Against Harassment

In addition to federal protections, many states have their own laws targeting abusive debt collection practices. These laws often mirror the FDCPA but may include stricter rules or additional safeguards. For example, some states impose tighter restrictions on contacting consumers about debts that are no longer legally enforceable (time-barred debts).

Another key difference lies in the penalties. While the FDCPA does not allow for punitive damages, some state laws do, especially when dealing with extreme misconduct. Additionally, state laws addressing unfair and deceptive practices may apply to debt collection efforts, offering another layer of protection. Debt collection remains one of the top sources of consumer complaints to agencies like the FDIC and the Consumer Financial Protection Bureau (CFPB).

Original Creditors vs. Debt Collectors: Legal Differences

Understanding the distinction between original creditors and third-party debt collectors is crucial because they are subject to different rules. The FDCPA primarily governs third-party debt collectors, meaning it generally doesn’t apply to original creditors like banks, hospitals, or utility companies.

However, some states extend protections to cover original creditors. For instance, Oregon’s Unlawful Debt Collection Practices Act (OUDCPA) applies to both third-party collectors and original creditors. This means certain actions might be illegal under state law even if they don’t violate the FDCPA. To fully understand your rights, it’s a good idea to contact your state attorney general’s office for information on local laws.

Steps to Stop Creditor Harassment

If you’re dealing with creditor harassment, you have rights under the Fair Debt Collection Practices Act (FDCPA). To protect yourself and take control of the situation, it’s important to follow a clear and strategic plan. Here’s how you can address creditor harassment and safeguard your rights under both federal and state laws.

Keep Records of All Creditor Contact

Detailed record-keeping is one of the most effective ways to protect yourself. Every interaction with debt collectors – whether it’s written communication or a phone call – can serve as valuable evidence if you need to escalate the matter. Start by saving all letters, emails, voicemails, and text messages. For phone calls, jot down the date, time, and a summary of what was discussed. These records can be critical if you need to request debt validation or take legal action. With everything documented, you’ll be in a stronger position to dispute any questionable claims.

Request Debt Validation

Under the FDCPA, you have the right to request proof that a debt is legitimate. Within five days of their first contact with you, debt collectors are required to send a written validation notice. This notice must include:

"Within five days after the initial communication with a consumer in connection with the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written notice containing — the amount of the debt; the name of the creditor to whom the debt is owed; a statement that unless the consumer, within thirty days after receipt of the notice, disputes the validity of the debt, or any portion thereof, the debt will be assumed to be valid by the debt collector; a statement that if the consumer notifies the debt collector in writing within the thirty-day period that the debt, or any portion thereof, is disputed, the debt collector will obtain verification of the debt or a copy of a judgment against the consumer and a copy of such verification or judgment will be mailed to the consumer by the debt collector; and a statement that, upon the consumer’s written request within the thirty-day period, the debt collector will provide the consumer with the name and address of the original creditor, if different from the current creditor."

If you question the validity of the debt, you have 30 days from receiving this notice to dispute it in writing. In your dispute, include your full name, account number, and any other identifying details. Keep copies of your letter and proof of mailing, such as a certified mail receipt. Once the dispute is submitted, the debt collector must halt all collection efforts until they provide verification of the debt. If the debt is verified and you wish to stop further contact, you can take the next step.

Send a Cease-and-Desist Letter

If you want to put an end to creditor harassment, sending a cease-and-desist letter can be an effective step. While this won’t erase the debt, it legally requires the debt collector to stop contacting you, except to confirm they’ve stopped collection efforts or to notify you of any legal actions they plan to take. When writing the letter, include your full name, address, account number, and clearly state that you are demanding all further communication cease. Send the letter via certified mail with a return receipt, so you have proof it was received. Before sending, it’s a good idea to understand the potential legal consequences of this action.

Taking these steps can help you regain control and ensure that your rights are respected throughout the process.

When to Hire a Lawyer

If your efforts to stop creditor harassment haven’t worked, it might be time to consider hiring a lawyer. While many cases can be handled independently, there are specific situations where professional legal assistance becomes a necessity. Knowing when to reach out to an attorney can mean the difference between ongoing harassment and reclaiming your peace of mind.

One key moment to seek legal help is when creditors persist in contacting you despite your attempts to address the situation. A legal expert explains:

"You may not realize that you have protection against illegal harassment under the federal Fair Debt Collection Practices Act and Massachusetts Consumer Debt Collection Act. You may also not even think to retain an experienced debt collection harassment attorney. However, without legal help, stopping abusive communications can be exceedingly difficult, assert your legal rights to compensation, and find a way out of your financial difficulties."

Another critical time to consult an attorney is when you receive a court summons. Ignoring such a notice can lead to severe consequences, including default judgments, wage garnishment, or frozen bank accounts.

"If you get a summons notifying you that a debt collector is suing you, don’t ignore it. If you do, the collector may be able to get a default judgment against you (that is, the court enters judgment in the collector’s favor because you didn’t respond to defend yourself) and garnish your wages and bank account. If you are sued by a debt collector, you may want to consult an attorney to discuss your options."

Other situations that call for legal advice include cases where debt collectors charge more than what’s legally allowed or when you suspect the debt is time-barred under statute of limitations laws.

How Attorneys Help With Creditor Harassment Cases

Hiring an attorney brings a level of expertise and authority that can significantly change the dynamics of your case. Lawyers can take over all communication with debt collectors, giving you immediate relief from the constant stress of harassment.

When negotiating settlements, attorneys use their deep understanding of debt collection laws to secure better terms than you might achieve on your own. They can also help you pursue compensation for violations of the Fair Debt Collection Practices Act (FDCPA) by documenting the harassment and building a strong case on your behalf.

Legal representation carries weight. As highlighted in Avila v. Rubin:

"a delinquency letter from an attorney conveys authority and implies that the attorney supervised or actually controlled the procedures by which the letter was sent."

This perceived authority often prompts debt collectors to approach the situation more cautiously, making them more likely to resolve disputes quickly and fairly.

Suing Creditors Who Break the Law

Beyond stopping harassment, you may also have the option to take legal action if creditors violate the law. Under the FDCPA, you have one year from the time of the offense to file a lawsuit. Winning such a case can result in up to $1,000 in statutory damages, compensation for any actual harm, and reimbursement for attorney fees and court costs.

Recent cases show how attorneys successfully hold creditors accountable. For instance, in Crawford v. Senex Law, a law firm was found liable under the FDCPA for sending collection notices on a landlord’s letterhead. Similarly, in Bassett v. Credit Management Services, the court determined that the FDCPA applies to lawyers who regularly pursue consumer debt collection through litigation.

Your attorney will rely on your detailed records to uncover violations, calculate appropriate damages, and present compelling evidence. Often, debt collectors prefer to settle rather than face a trial, especially when they’ve clearly broken the law. An experienced lawyer can negotiate these settlements, ensuring you receive fair compensation without the uncertainty of a lengthy court process.

sbb-itb-2a9374f

Other Options: Bankruptcy and Debt Relief Programs

When traditional methods fail to stop relentless creditor harassment, it might be time to explore broader solutions. Bankruptcy and debt management programs each provide unique ways to address debt while offering protection from aggressive creditors.

How Bankruptcy Stops Creditor Harassment

Filing for bankruptcy activates an automatic stay, which instantly halts creditor actions like phone calls, wage garnishments, lawsuits, and threats. This protection applies to both Chapter 7 and Chapter 13 bankruptcy filings. Chapter 7 typically wipes out most unsecured debts within 4–6 months, giving you a clean slate. Chapter 13, on the other hand, reorganizes your debt into manageable payments over 3–5 years.

The automatic stay also blocks creditors from filing new lawsuits or continuing wage garnishments. If creditors ignore this legal protection and continue contacting you, they could face penalties. To address such violations, make sure to document every instance – note dates, times, and the nature of the contact – and report them to your attorney or the bankruptcy court.

| Feature | Bankruptcy | Debt Consolidation |

|---|---|---|

| Creditor Harassment | Stops immediately with automatic stay | Creditors may still pursue legal action |

| Lawsuit Protection | Prevents lawsuits and garnishments | Does not offer legal protections |

| Debt Elimination | Chapter 7 erases unsecured debts | Consolidates payments without reducing debt |

| Timeframe | Chapter 7: 4–6 months; Chapter 13: 3–5 years | Varies, often years with minimal progress |

| Asset Protection | Protects homes, cars, and retirement accounts | Offers no asset protection |

Unlike debt consolidation, which simply restructures your payments without reducing the total amount owed, bankruptcy can provide a financial reset.

If bankruptcy feels too drastic, a structured debt management plan may be a better fit for your needs.

Using Steps To Be Debt Free for Debt Management

While bankruptcy offers immediate legal safeguards, debt management programs take a steadier, more gradual approach. If you’re looking to avoid bankruptcy but still need relief from constant collection efforts, Steps To Be Debt Free provides a structured way to manage your obligations. The process begins with a thorough assessment of your current debt, payment history, and overall financial situation. This evaluation helps create a personalized plan to guide you toward becoming debt-free.

Debt management programs like this can be particularly effective at reducing collection calls. By showing creditors that you’re taking active steps to address your debt, they may become more cooperative. These programs often include benefits like affordable monthly payments and a clear timeline for paying off your debts. Many participants complete their plans in three to five years and may even see their credit scores improve by 62 to 84 points.

"Debt management programs offer a practical solution for those struggling with unsecured debt. By working with a reputable credit counseling agency, you can consolidate payments, reduce interest rates, and create a structured path to becoming debt-free."

Success in a debt management program requires consistent effort and timely payments, making it ideal for individuals with a steady income. Steps To Be Debt Free even offers a free consultation to help determine if this approach is right for you.

When choosing between bankruptcy and a debt management program, it’s essential to weigh your circumstances. If you’re dealing with lawsuits, wage garnishments, or relentless collection calls, bankruptcy might provide the immediate relief you need. However, if you have a stable income and want to pay off your debts while avoiding the long-term credit impact of bankruptcy, a structured debt management program could be the better option.

Report Creditor Harassment to Government Agencies

If creditor harassment persists despite your efforts, reporting the violations to government agencies can be an effective way to protect yourself and hold collectors accountable. Both federal and state agencies have the authority to investigate complaints, enforce regulations, and track patterns of misconduct. By reporting harassment, you not only address your situation but also contribute to broader efforts to prevent abuse.

File a Complaint with the Consumer Financial Protection Bureau (CFPB)

The Consumer Financial Protection Bureau (CFPB) is a key resource for addressing debt collection violations. If a debt collector is harassing you, you can file a complaint with the CFPB. This agency has handled millions of consumer complaints and works to ensure fair treatment in financial matters.

You can submit your complaint online through the CFPB website or by calling their multilingual helpline. When filing, provide a detailed account of the issue, including important dates and any supporting documents (up to 50 pages). If a debt collector fails to follow the Fair Debt Collection Practices Act (FDCPA), you can also report this through the CFPB. Once your complaint is submitted, the CFPB may forward it to the company in question and work to secure a response on your behalf.

Report to the Federal Trade Commission (FTC)

The Federal Trade Commission (FTC) is responsible for enforcing federal debt collection laws and combating fraudulent business practices. If you encounter issues with a debt collector, reporting them to the FTC is another step you can take. The FTC plays a critical role in preventing deceptive, abusive, and unfair practices in debt collection, while also providing resources to help consumers recognize and avoid these behaviors.

Filing a complaint with the FTC not only addresses your specific case but also contributes to a larger database used to track repeat offenders. This information supports enforcement actions and consumer education efforts, ensuring that bad actors face consequences under the law.

Contact Your State Attorney General’s Office

Your state attorney general’s office is another valuable ally in addressing creditor harassment. Many states have their own debt collection laws, which may offer additional protections beyond federal regulations. If you believe a debt collector is breaking the law, you can file a complaint with your state attorney general’s office. They have the authority to investigate and take action against violations, especially when state laws provide stricter safeguards.

To report a violation, provide a detailed account of the incident along with any supporting documents. Most state attorney general offices offer online complaint forms or dedicated hotlines for consumer protection issues. Taking this step ensures that local violations are addressed and helps you leverage the full protections available under both federal and state laws.

Conclusion: Stop Creditor Harassment and Get Relief

Facing creditor harassment can feel overwhelming, but you have legal protections designed to help you. The Fair Debt Collection Practices Act (FDCPA) and various state laws are there to shield you from abusive collection tactics. Knowing these rights is the first step toward taking control.

Follow the steps outlined in this guide to establish boundaries and document each interaction. A well-maintained paper trail not only reinforces your position but also serves as a crucial legal safeguard. These actions are essential for defending yourself against unfair practices.

If the harassment continues despite your efforts, it may be time to take additional steps. Seeking legal assistance can help you tackle more serious issues, like stopping wage garnishments, protecting your assets, or finding sustainable debt management solutions. As attorney Seth E. Dizard aptly puts it, "I think that good legal advice is almost exactly the same as having a good insurance policy. Nobody bats an eye at getting an insurance policy for protection. No one should bat an eye at getting legal advice for similar protection".

Professional guidance can provide clarity on your options, from legal representation to debt settlement programs or structured management plans. These resources not only reduce financial stress but also help you regain control over your finances. Platforms like Steps To Be Debt Free offer comprehensive tools to evaluate your financial situation and craft effective strategies for managing and reducing debt. Additionally, report any violations to the CFPB, FTC, or your state attorney general’s office to ensure your rights are upheld.

Taking action is about more than stopping harassment – it’s about reclaiming your financial freedom. Armed with the right knowledge and tools, you can protect your rights and move toward a more secure future.

FAQs

What can I do if a debt collector keeps harassing me after I’ve sent a cease-and-desist letter?

If a debt collector keeps contacting you after you’ve sent a cease-and-desist letter, here are some steps you can take to address the situation:

- Keep detailed records: Write down every instance of contact, including the date, time, and what was said. These notes can serve as key evidence if you decide to take further action.

- Report the misconduct: Submit a complaint to the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general’s office. Debt collectors must comply with the Fair Debt Collection Practices Act (FDCPA), and reporting violations helps enforce these rules.

- Consult a legal professional: Reach out to an attorney who knows debt collection laws. They can explain your rights and guide you on whether you can seek damages for any FDCPA violations.

By taking these steps, you can assert your rights and ensure debt collectors are held accountable for unlawful practices.

How can I find out if my state provides extra protections against creditor harassment beyond the FDCPA?

Some states have their own rules that go beyond the protections provided by the Fair Debt Collection Practices Act (FDCPA). These state-specific laws might impose stricter limits on how often creditors can reach out to you or define more clearly what qualifies as harassment. For instance, California enforces the Rosenthal Fair Debt Collection Practices Act, while Ohio has its own Commercial Sales Practices Act.

If you’re unsure about the laws in your state, take a closer look at your local consumer protection regulations or reach out to a legal expert who focuses on debt-related matters. Knowing these laws can empower you to guard yourself against illegal actions by creditors.

When should you contact an attorney about creditor harassment, and how can they help?

If you’re facing relentless calls from creditors, intimidating threats, or serious legal actions like lawsuits or wage garnishment, it might be time to reach out to an attorney. They can step in to defend your rights, put an end to unlawful harassment, and ease the burden of dealing with creditors on your own.

An attorney can also act as your negotiator, working directly with creditors to pursue more manageable repayment terms or even settlements. With their knowledge, you’ll gain clarity about your legal options and protection against any unfair treatment.